Our Work

We support leading-edge research and study in anthropology and related disciplines in order to foster a better understanding of humankind and the critical problems we face.

Meet our Scholars >

Meet our Artists >

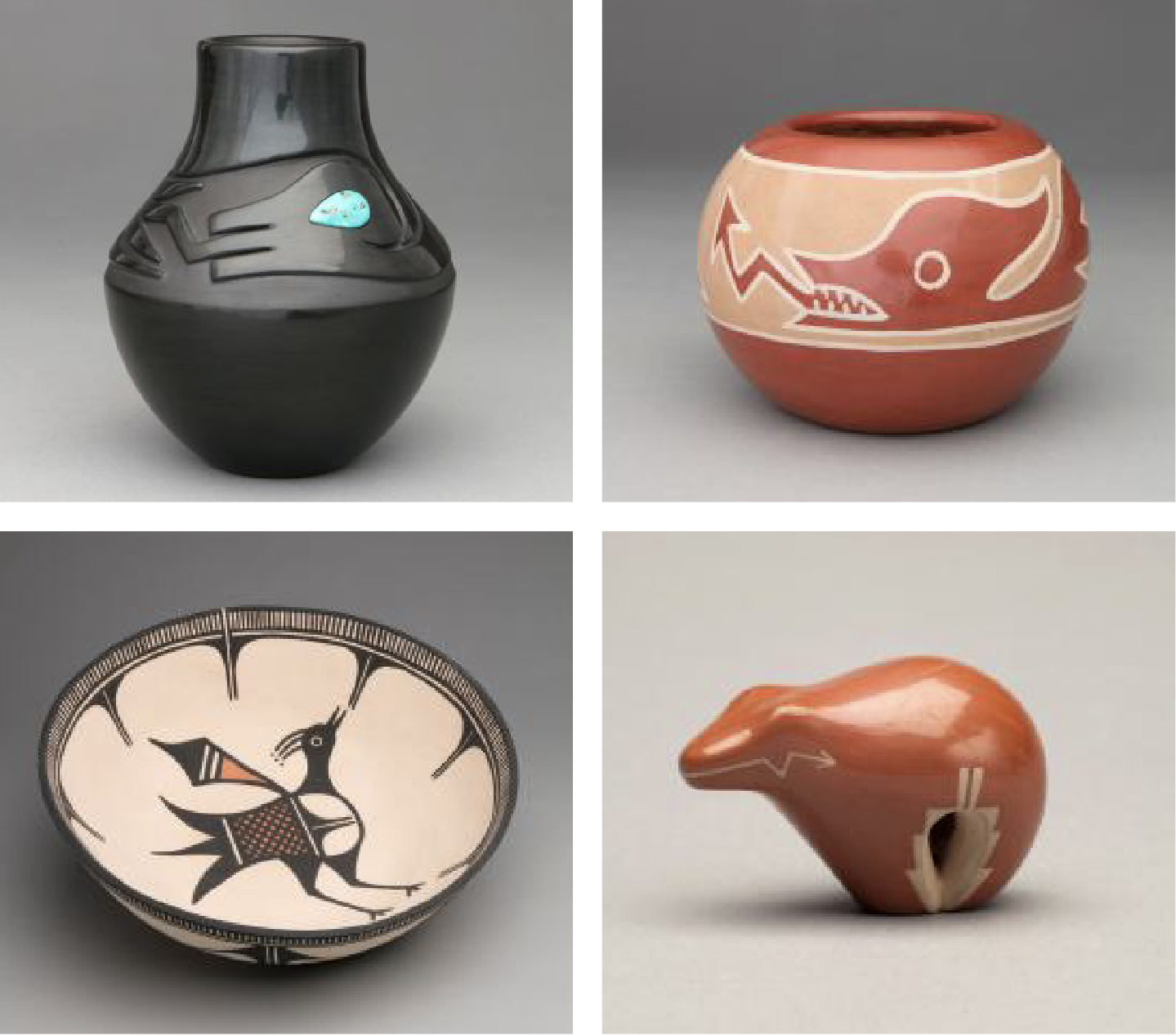

Our Collection

We steward one of the most important collections of Southwest Native American art and guide museums around the world on best practices in collaborating with source communities.

See the Collection >

Our Community

We offer symposia, salons, classes and field trips that give you a unique opportunity to meet and learn from our scholars and artists. Find out how you can get involved with our diverse, dynamic community.

Join SAR >

SIGN UP FOR OUR WEEKLY NEWSLETTER

Engage in the intellectual and creative life of SAR.

Three SAR Alumni in the National News

Ned Blackhawk (1996), Tiya Miles (2007), and Jeffrey Gibson (2019) at SAR. The Sunday, April 14 edition of the New York Times mentions notable achievements by three SAR alumni. Both Ned Blackhawk (Katrin Lamon Fellow, 1996-1997; SAR Board of Directors 2017-2023)...

SAR Welcomes New Board Directors

Over the past six months, the School for Advanced Research (SAR) Board of Directors appointed eight new Board and Advisory Board members. They bring experience in scholarship, language, marketing, development, social change programs, art history, writing and...

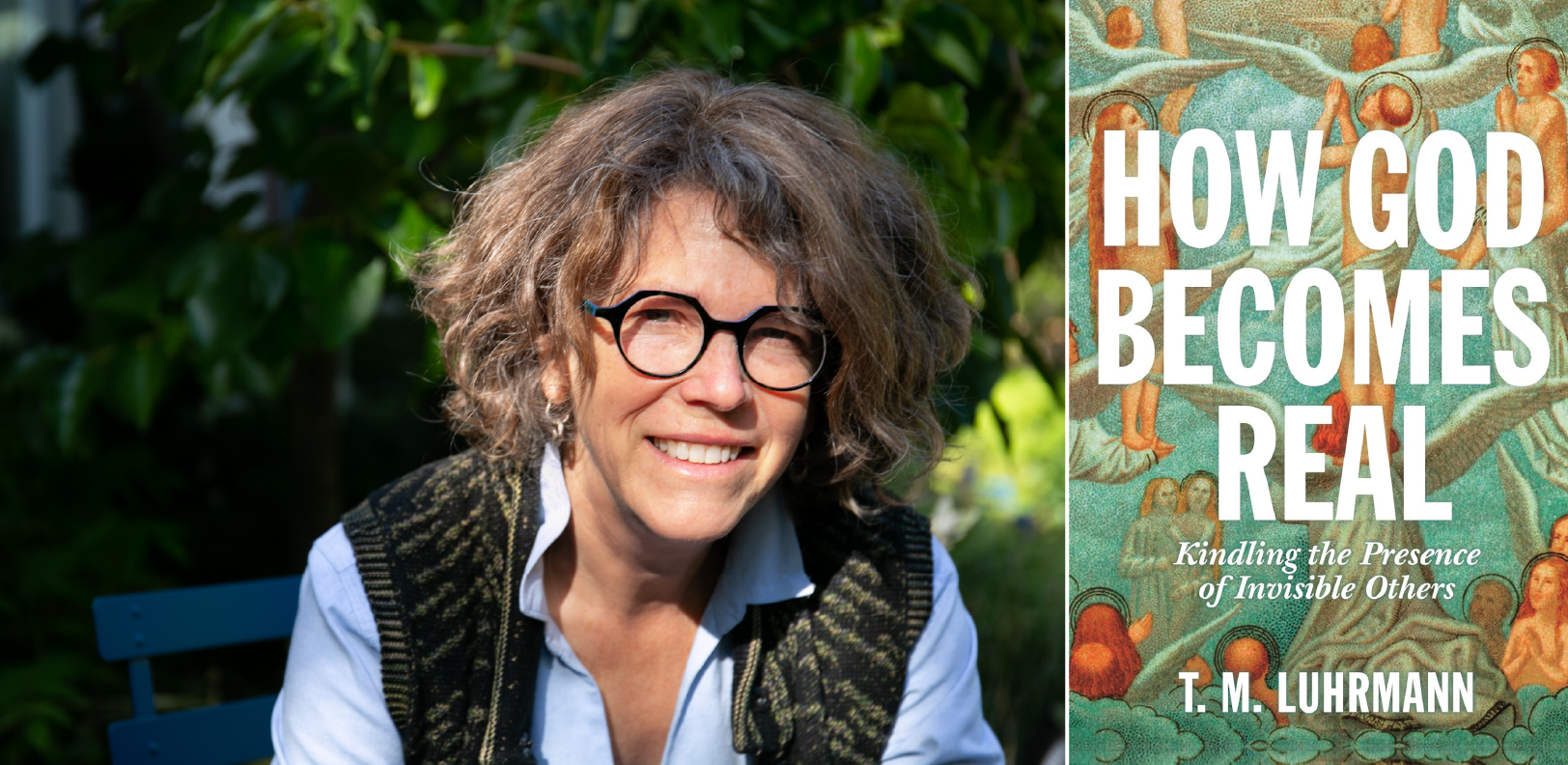

School for Advanced Research Awards the 2024 J. I. Staley Prize to T. M. Luhrmann for “How God Becomes Real”

Top Prize in Scholarship and Writing in Anthropology Awarded for Book That “Shows How Faith Is ‘Kindled’, or Intentionally Brought into Being” Santa Fe, New Mexico—The School for Advanced Research is pleased to announce the recipient of the 2024 J. I. Staley Prize:...

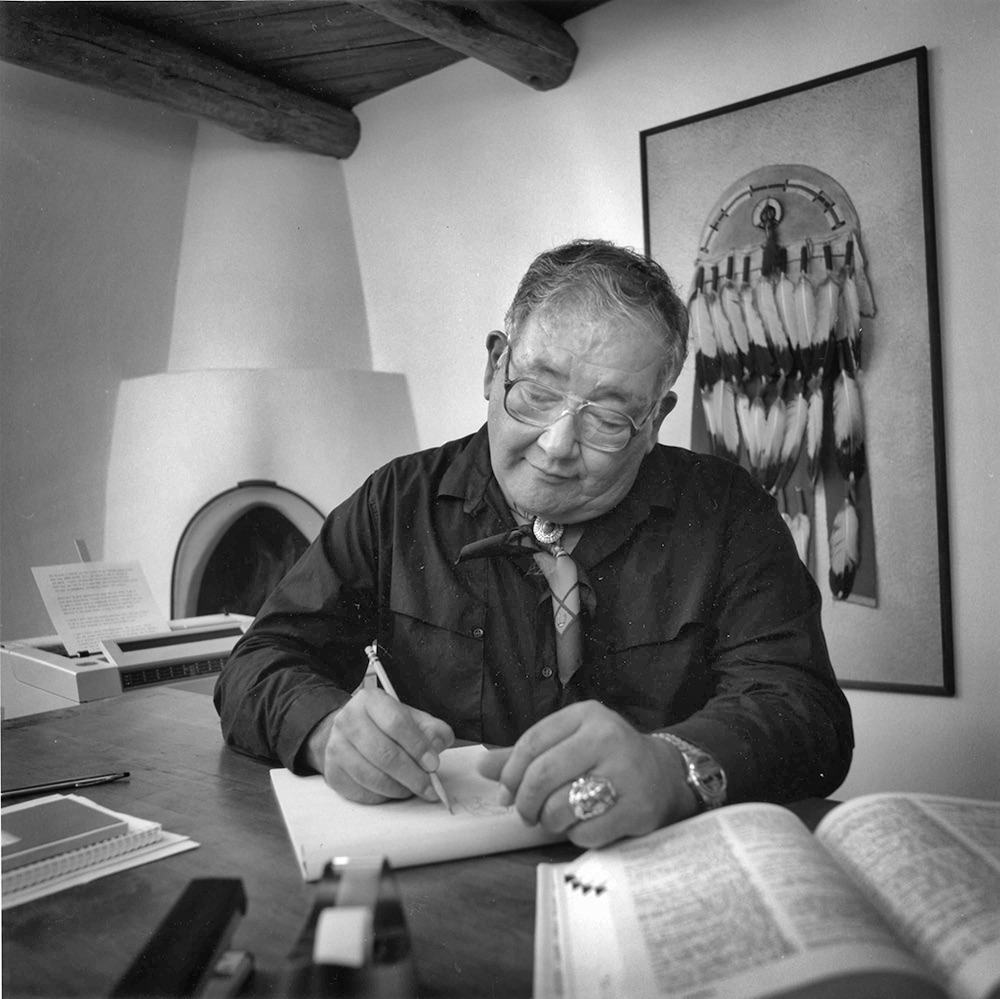

N. Scott Momaday, 1934–2024

Navarre Scott Momaday, the nation's most celebrated Native American writer, died at his home in Santa Fe on January 24. He was 89. Momaday, a member of the Kiowa Tribe, is remembered at SAR for his long service to this institution: as a Katrin Lamon Resident Scholar,...

SAR Receives $900,000 Grant from the National Endowment for the Humanities

Image: Collections review with the Pueblo of Acoma at the Indian Arts Research Center The School for Advanced Research (SAR) is honored to announce that it has been awarded a grant in the amount of $900,000 from the National Endowment for the Humanities (NEH). The...

2024: A Look Ahead

New Year's festivities inevitably include reviews of the year that's winding down. For SAR's first blog post of 2024, I prefer to pivot toward the near future. Although some details have yet to fall into place, I’m pleased to identify highlights of our programming for...